|

Potential

Revenues:

|

$$$$$

|

|

Revenue Source:

|

Donations from high-income individuals

|

|

Advertising:

|

Direct appeal via introduction

|

|

Equipment/Supplies:

|

Coffee-table quality book on your organization

|

|

Partners:

|

www.Blurb.com

www.Snapfish.com |

|

Volunteers

Needed:

|

Board Member Introductions, photo and book

design help.

|

How It Works:

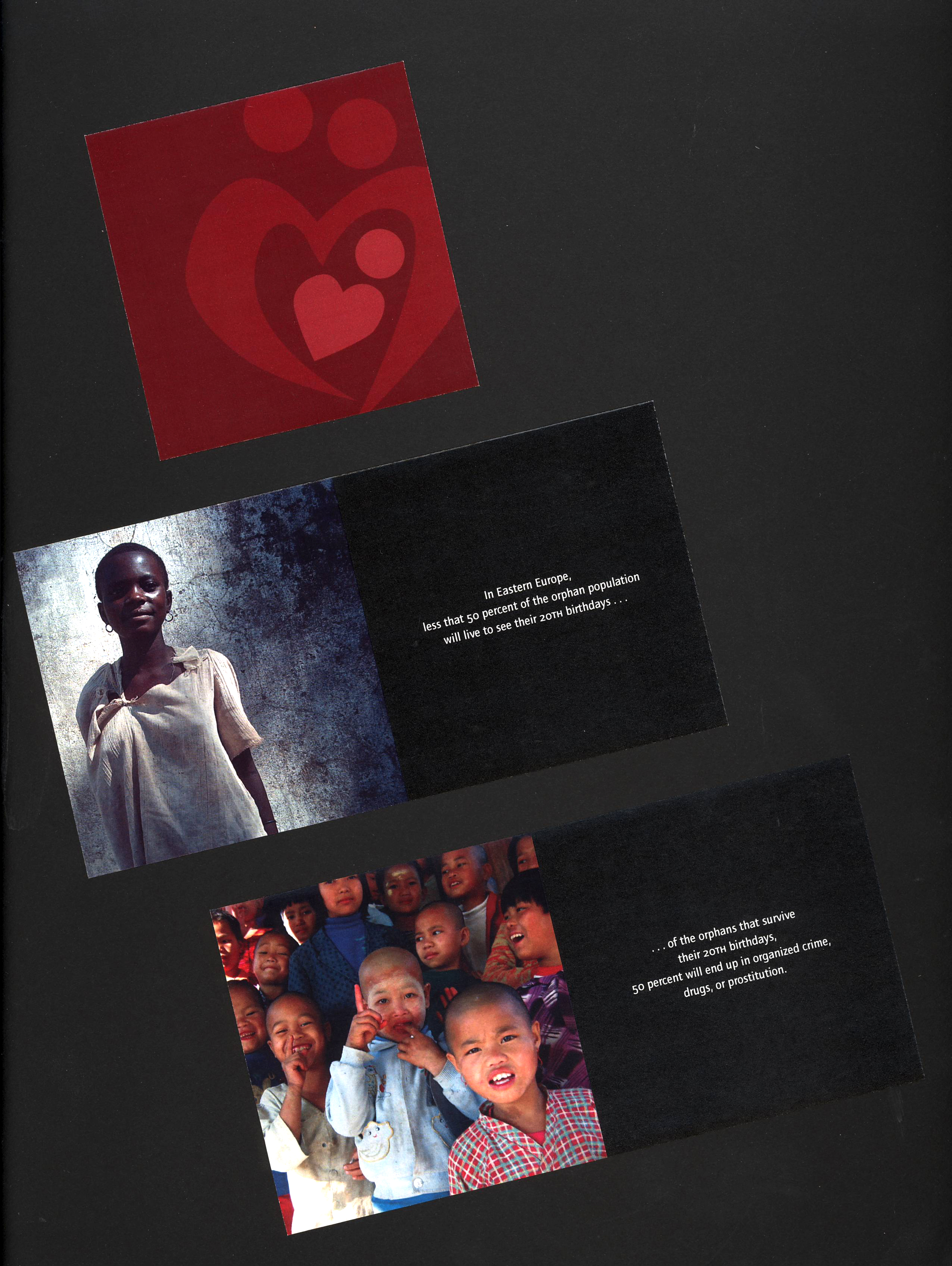

Many 501(c)(3 )non-profit

organizations can better leverage their Board members’ connections by making

available a high-quality cause book for high-income individuals. The cause book tells your story in pictures

and short messages, so that you can create an emotional connection with the

high-income individual. Even without

that emotional connection, there are important tax considerations for a large

donation. The high-income cause book

starts the process.

Imagine a

coffee-table quality book with pages of struggling orphans and orphanages to set

the stage for how your organization helps.

Imagine showing kids who now have jobs thanks to your group’s

efforts. Imagine showing cancer

survivors that have benefitted from your organization. Tell your story.

The new online

services like www.Blurb.com, www.Snapfish.com and many others make these

high quality books possible, in quantities of one. They look like they’ve come off the presses

of a high-end printer. All you need is

about 20-50 photos that tell your story.

The more you have the better.

On one page,

place the picture so that it fills the entire page without a border. On the facing page you tell a small piece of

your story. If you’re helping foster

kids or orphans, then a shocking statistic like “there’s over 143 million

orphans in the world” is all that needed on the opposing page. If you’re fighting a specific type of cancer,

then pictures of cancer survivors on one page, and their story on the other

page, will get the same effect.

You also need to tell how your group uses the

donations that it receives. Explain how

you spend the money and what group of people or cause benefits as a result. The more you can break down how money is

spent, the easier it is for a high-income individual to figure out how they can

help. Perhaps they’ll sponsor a person, or

a new facility, or a project. Perhaps

they’ll sponsor much more.

Ideas to Consider:

You will want to

be prepared with other non-cash options to present, which is why there are

several “planned giving” venues included in this book. Make sure you are well-versed in how each of

these work, or bring someone along who is well versed in the planned giving

instrument.

Consider asking

each Board member to make your organization a 1-3% beneficiary in their life

insurance policy. That’s usually a

one-page document that needs to be prepared, and easily done. In turn, if they ask a high-income individual

to do the same, it will be more credible if they can say they’ve already done

it.

Each of the

planned giving venues presented offers a specific tax advantage, as does an

outright cash donation. Never forget to

mention that you’re a 501(c)(3 ) or similar tax-deductible entity, if you have

that status with the Internal Revenue Service.

Source of Idea:

Unknown. This concept was first

suggested to the author by Gary Hespenheide of Hespenheide Design, in Thousand

Oaks, CA.

Back to Home Page

|