List Price: $14.95

Discounted Price: $11.57

Gift Certificates are available when you check out

Life Insurance - "Life Settlements"

|

Potential Revenues: |

$$$$$ |

|

Revenue Source: |

Life insurance payment to your organization as a beneficiary |

|

Tax Benefit to Donor: |

Tax deduction as per the discussion below |

|

Other Benefit to Donor: |

Easy to set up without capital |

|

Potential Donors: |

Any individual |

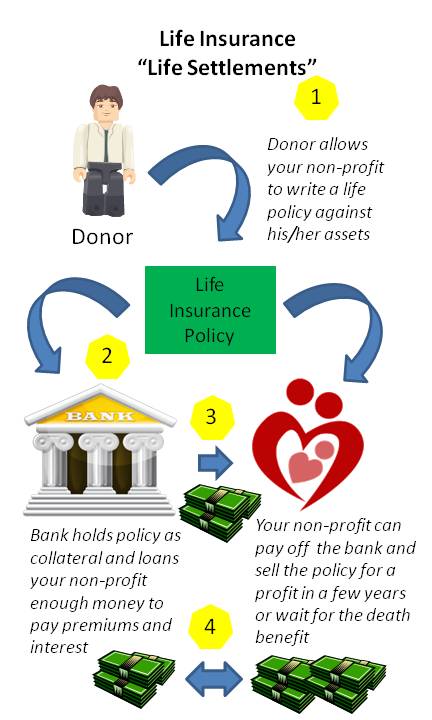

How It Works:

Life Settlements are considered to be a “no cost” gift that can be given to a non-profit organization. In a life settlement program, donors can provide a substantial gift to a non-profit organization without contributing cash or property. The gift is simply based on their ‘insurability.’ Any person within the proper age can do this – usually in their 70’s and 80’s. With the donor’s permission, the non-profit organization creates a Trust, and the Trust takes out an ordinary life insurance policy on the donor in the amount determined by the donor, given his or her net assets minus any existing life insurance policies.

In a “Life Settlement” the donor never pays the premiums for the policy because a bank - independent from the donor - lends the full amount of the annual insurance premiums (plus the interest on that loan) to the non-profit organization’s Trust, and holds as collateral the insurance policy owned by the Trust. No other collateral or credit guaranty is required from the donor, and the insured donor is never obligated on the bank note.

In the future, if the non-profit’s circumstances warrant the disposition of this asset, the Trust could elect to sell the policy in a secondary market that’s evolved around life settlements. This allows the non-profit to pay off the bank loans for the premiums, while at the same time, typically realizing net cash proceeds of 15% of the face value of the policy. The proceeds are given to the non-profit organization; the donor remains alive and can see the benefit to the non-profit organization from this substantial gift. Depending on circumstances, the non-profit organization Trust could hold the policy until the donor is deceased and the non-profit organization, as beneficiary, would realize the face value of the policy minus the loan repayment for the premiums.

The donor never makes any cash payments nor provides a loan guarantee. There is never any effect on the donor’s will, or trusts, or any part of their present or future inheritance plans. Also, nothing affects the donor’s use of their assets at any time, and in fact, their assets could decline significantly in value after the policy is purchased by the non-profit organization’s Trust, yet nothing would change either for the non-profit organization or the donor.

If the Trust elects to sell the policy before maturity, an institutional purchaser (usually large financial institutions) could continue to invest in the policy by paying all of its premiums and awaiting the face amount payment to occur in the future when the donor is deceased. It’s considered a safe “hedge fund” against other, more risky investments.

Example

of Gift Amounts if Sold on Secondary Market

(Approximation):

Policy Type: Universal Life Policy Type: Universal Life

Insured: 82-year-old Male Insured: 73-year-old Female

Face Amount: $5,000,000.00 Face Amount: $2,500,000.00

Net Proceeds: $598,983.45 Net Proceeds: $299,491.73

Ideas to Consider:

The “Life Settlement” is a controversial insurance gift concept, due to its having evolved into an industry. The appearance of secondary markets to sell these policies, as well as radio ads, is at the root of the controversy. These radio ads appear in many parts of the country suggesting that investors are interested in purchasing life insurance policies of senior citizens (for their value in this secondary market). Further research is merited to ascertain the value of using “life settlements” as part of your planned giving portfolio. Use caution to ensure this program reflects properly on your non-profit.

Questions? Info@FundraisingAlmanac.com